Centralised investment propositions are a familiar concept among advice companies, but a similar approach for clients in decumulation appears to be less common.

Four in five who were surveyed for Aegon’s Adviser Attitudes 2021 report said they had a CIP, but the research found that centralised retirement propositions were less common among advice companies, at 53 per cent.

“This is surprising five years on from pensions freedoms, given that retiring investors make up such a large proportion of their client base,” the report says.

Indeed, 62 per cent of adviser assets are for clients receiving retirement advice, according to separate research on CRPs by NextWealth for M&G Wealth.

How common are CRPs?

M&G Wealth and NextWealth’s study similarly found that half of companies had a CRP, and one in five (20 per cent) said their company intended to introduce a proposition during 2021, bringing the total proportion of companies with a CRP to 70 per cent by the end of year, if realised.

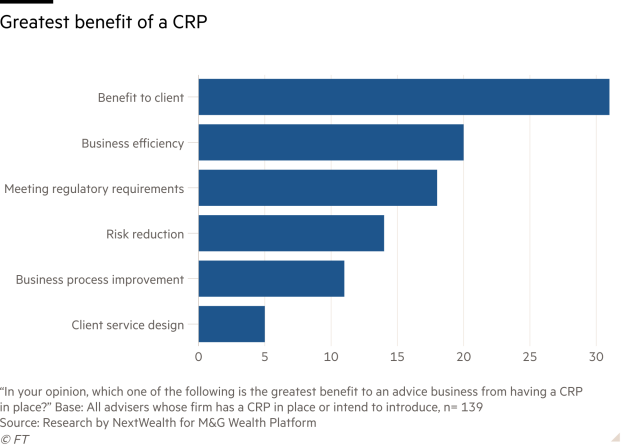

Advisers whose company already had or intended to introduce one, identified benefit to the client (31 per cent), business efficiency (20 per cent) and meeting regulatory requirements (18 per cent) as the greatest benefit of a CRP.

And three in seven companies (43 per cent) that already had a CRP said they did not encounter any particular challenges to rolling it out across the business.

Advisers at larger companies were also more likely to have a CRP, NextWealth found. More than half (54 per cent) of advisers at companies with more than five client-facing advisers had one, compared with 40 per cent of sole traders.

Indeed, half of companies with more than 10 advisers said the CRP was a requirement, and that anyone wishing to go outside its scope must justify doing so.

On the other hand, the majority (79 per cent) of advisers whose company did not implement a CRP, or did not intend to introduce one, said the main reason was because they preferred to tailor advice to each client individually.

“We appreciate that some advisers manage drawdown manually. However, a well-structured CRP demonstrates a robust, compliant and scalable process to deal with clients in decumulation,” says Mark Duggan, director of sales and marketing at Bordier UK, a specialist investment management company.

Jan Holt, strategic relationship manager at Scottish Widows, adds that a CRP demonstrates good governance, improves business efficiency, reduces business associated risks and improves client outcomes. She says: "A CRP provides a framework for recommending how income can be delivered sustainably throughout retirement and also how other client needs and objectives may be met.

"However, if too narrow, a CRP won't cover all of the considerations that may have a bearing on the most appropriate recommendation for a client."

For those hesitant about CRPs, NextWealth’s research indicates that even advisers whose company has a CRP have scope to go outside the proposition and consider bespoke solutions for clients, with a quarter saying they do so once every six months.