By the time you read this, there will be less than four months to go until the Financial Conduct Authority’s investment pathways will need to be offered to the roughly 30 per cent of consumers moving their defined contribution pensions into drawdown without consulting a regulated financial adviser.

This may catch quite a few clients with advisers, who are either starting drawdown or, more likely, moving more funds into drawdown without recently speaking with their adviser.

From August, drawdown product providers will need to implement the FCA-prescribed investment pathways to help consumers make the most of their retirement savings by lining up their savings access needs with the right decumulation choice as follows:

• Option one: I have no plans to touch my money in the next five years.

• Option two: I plan to use my money to set up a guaranteed income (annuity) within the next five years.

• Option three: I plan to start taking my money as a long-term income within the next five years.

• Option four: I plan to take out all my money within the next five years.

The FCA should be commended for trying to create a ‘robo-guidance’ solution to the problem of unengaged retirees – a third of who default into their existing pension provider’s drawdown policy, and a third of these defaulters have their savings plonked into cash or cash-like assets today.

As advisers will know well, leaving money festering in cash funds for long periods seriously erodes its purchasing power.

Pathways force the saver to decide what they want to do with their money once they can access it at age 55.

Key Points

- From August, drawdown providers will need to implement investment pathways

- Many people with small pots are unengaged

- An adviser will need to be involved in the process

Broadly, in option one, they may decide that they are going to retire much later and will not need to access the money for five years or more.

Option two steers them to purchase an annuity based on the consumer’s desire to secure a guaranteed income in retirement.

Option three suggests that they want to use the money for drawdown, but an investment solution still needs to be found that optimises income long-term; while option four is the active choice to move all the pensions savings out within the next few years ready to spend.

Even the unengaged will make a decision because they will not get their tax-free cash out until they do.

Their drawdown provider must then offer one ready-made investment solution for the option chosen by the saver.

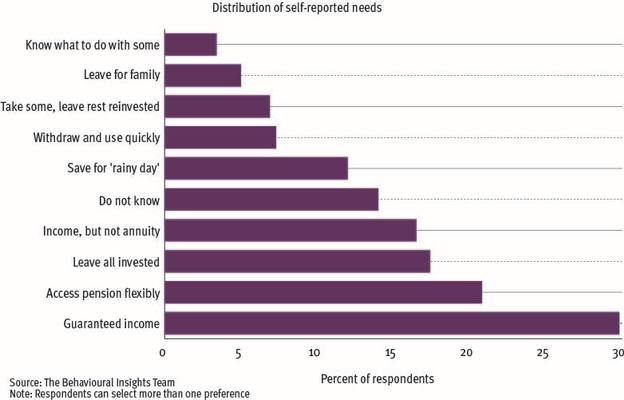

However, investment pathways fails to allow for splitting of the pot so that a portion might be earmarked to meet a particular short-term goal (pay for a new car or expensive holiday), while the rest is retained to provide a long-term income at the point of actual retirement in, say, 10 years’ time, even though consumer research tells us that is precisely what many people want to do.

To properly understand the varied circumstances that consumers find themselves in as they go into decumulation, it is worth reading the Behavioural Insights Team’s research document entitled ‘Increasing comprehension of investment pathways for retirement’.