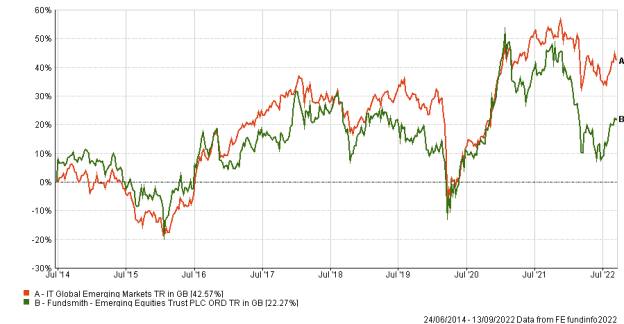

Given the underperformance since launch, it may be said then that the fundamental thesis underpinning the launch of the trust was wrong, that is, the idea that emerging markets would outperform developed markets, and that this would be reflected in stock market growth.

Smith has always been a confident and forthright character, and indeed Smith lives in an emerging market economy (Mauritius), but the failure of this trust may be a function of the fact that the skills and process the fund manager uses in developed markets to find the type of large cap, mature businesses he craves, simply do not work in the emerging world when it comes to stock selection.

Smith also scorns the idea of using economics and macro events as an investing tool, but emerging markets are open economies and much more sensitive to macro factors such as interest rate movements, so a portfolio that does not heed macro trends is vastly harder to construct in emerging markets.

And that could be the key to the trust’s failure; as Smith’s preferred type of 'quality' company is simply a scarce commodity in a world of political upheaval.

david.thorpe@ft.com