Stocks are bonds and bonds are stocks. Such has been the extreme impact of ultra-loose monetary policy and sustained high levels of risk aversion that traditional market thinking has been firmly turned on its head.

Equity investors now come to the market for income, while bond investors are seekers of capital return.

So pronounced is this strange dynamic it has reached the stage where investors are queuing up to hold negatively yielding government bonds, and some credit, guaranteed to lose money on maturity.

Few, if any, would have predicted such an outcome.

Asset class conundrum

It is hard to envisage a catalyst that will see a significant rise in bond yields over the short run.

Brexit, global trade wars, low levels of global growth and the absence of inflation are likely to see rates suppressed for some time yet, supporting the lower-for-longer thesis.

However, this does not discount the potential for a shock event risk that could see yields spike.

Key Points

- Conventional market allocations have changed due to loose monetary policy

- There is a turbulent outlook for bonds

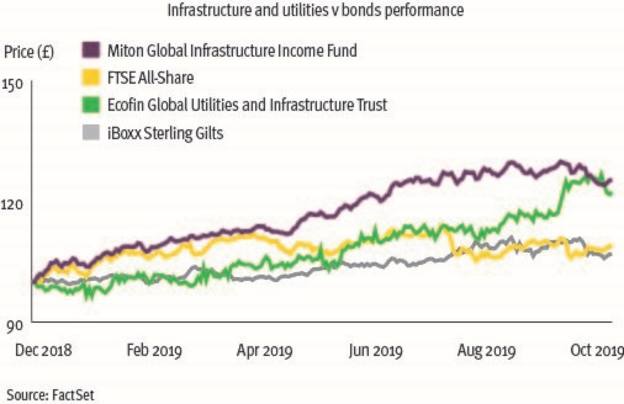

- Utilities and infrastructure equities are a good diversifier away from bonds

Global equities have remained buoyant at the same time as sovereign bonds have continued to rise, leading to a third of global bonds yielding negative rates.

In the long term, both markets cannot be right.

This is the stark conundrum currently facing investors.

One cannot, at the same time, be willing to take equity risk and be so keen to protect assets that one is prepared to suffer a guaranteed loss on sovereign bonds.

We believe, given this potential turbulent outlook for bonds, investors must consider the relative merit of investing in both government bonds and corporate bonds.

The first question is, are you prepared to wade into the fixed income waters?

While there is still positive yield to be found in government debt and credit, one only needs to assess duration risk to understand that even a 1 per cent move in rates will have a damaging impact on portfolio returns.

The second question is, are you being rewarded for this risk? We believe this is an unequivocal no, considering what is available outside the bond universe – and, particularly, in the world of defensive equities.

Navigating complexity

This is not to say equity markets are not also a complex place to navigate.

There are dichotomies within equity markets themselves.

Among the top global sectors in terms of recent performance are consumer staples (expensive quality yielding assets with stable growth), technology (expensive non-yielding growth assets) and utilities (cheap defensive yielding assets).

It appears investors are simultaneously looking for yield, protection and continued upside participation.

One would argue not all three requirements can be fulfilled at the same time, which implies these market dichotomies will have to be resolved one way or another.

We believe when market direction is uncertain and obvious inconsistencies appear, it is critical to stick to a valuation discipline.

This can prove painful until rational behaviour reinstates itself.

However, ultimately, buying assets that are cheap relative to their intrinsic worth and avoiding overpaying are the best ways to prevent significant losses in the future.