However, as he continues: "Smaller companies, while they traditionally tend to have the greatest expected return, are not usually suitable for income portfolios.

"This is due to smaller companies being in a growth phase of their life, and allocating revenue to growing rather than returning it to shareholders.

"These are of course equity based, and therefore unsuitable for anyone with a very low tolerance for risk, or a very short investment horizon - or a desire for capital preservation."

He stressed that fixed interest-based assets are currently experiencing a complex environment, which is due to low interest rates and the prospect of increases in rates over the medium term.

Mr Owen said: "There is a negative relationship between interest rate movement and the price of a bond which means as yields and rates increase it will be at the expense of capital depreciation – and investors could be net worse off. The relationship between the term of a bond and the credit risk needs to be considered carefully before investing.

"If you’re thinking about which sectors might be more stable, perhaps think about the defensive sector, which has a stable revenue generating ability – so, utilities or any areas where continual human need exists – from water companies to healthcare organisations say."

Compelling proposition

However, Emma Mogford, UK equity portfolio manager at Newton IM, which is part of BNY Mellon IM, says it is not all doom and gloom for investors seeking income.

She explains why: “We believe UK income funds continue to offer a compelling proposition for UK investors, with an average 4.2 per cent yield for those funds still targeting 110 per cent of the index yield.

"With the promise of 3 per cent growth in 2018, according to a Link forecast, they also offer the prospect of protecting income from inflation.”

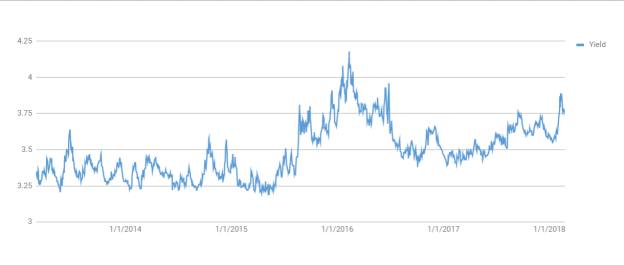

The below graph shows the yield generated on the FTSE All-Share.

Source: Morningstar

Ms Mogford also highlighted the benefits of seeking equity income through dividends and focusing on large cap firms. She added: “We believe there are benefits to diversifying the sources of income within a portfolio between those with a high starting yield and those with a lower, but still attractive, level of income with inflation beating dividend growth.

"Large caps in the UK continue to offer some of the most attractive starting yields and many have long histories of consistent payments."

For example, Royal Dutch Shell has not cut its dividend since 1945.

Slightly further down the capitalisation curve, there are also a number of mid cap companies in the FTSE 250 which offer a decent yield combined with good growth prospects. National Express, for example, increased its dividend by 10 per cent last year.