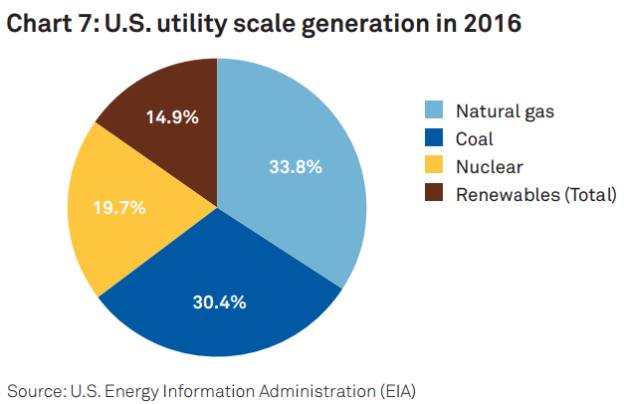

Citing figures from the US Energy Information Administration, the report showed 14.9 per cent of the total US utility scale generation in 2016 was in renewables (see pie chart).

This is estimated to rise significantly over the next decade as green technology evolves.

The report said regulated utilities in the US have been addressing the expansion of renewable and distributed generation capacity, and many are developing higher efficiency utility-scale solar and storage resources that can meet state renewable portfolio standards.

Whether the positive regulatory environment and supportive tax structure for renewables infrastructure in the US will continue under President Trump, who publicly stated climate change had been created by the Chinese to annihilate the US’s economic interests, remains to be seen.

For Ian Simm, chief executive of Impax Asset Management: “Even President Trump’s announcement to withdraw the US from the Paris Climate Agreement has done little to dent investor enthusiasm for investments in companies that provide solutions to environmental challenges.”

Who will pay?

The David Hale Global Economics report, Infrastructure as an Investment: Global Risks and Returns, also predicts the private sector will play an increasingly central role in the expansion of global infrastructure assets.

The fact is, government balance sheets have been stretched considerably, especially since the global financial crisis, so the private sector has been picking up the slack already and will continue to do so – hence the rise in the listed infrastructure asset class over the past decade.

In the case of large-scale projects, there is a case for bundling infrastructure projects together.

For example, in the US, the Penn State’s Department of Transportation bundled together 558 bridges into one project to help save money, deliver replacement of structurally deficient bridges more quickly and provide better value to taxpayers.

This was done in partnership with private initiatives. Similarly, Vela Energy Finance bundled together the financing for 42 solar energy parks in Spain.

This could present investors with a new potential infrastructure asset class.

The future

Mr Langley comments: “This expansion will be driven by growth in both developed markets and emerging markets.

“In developed markets, there is a significant amount of expenditure required to bring existing infrastructure stock up to a standard that meets current needs.”

“Alongside this,” he continues, “is the investment required to meet future needs. In the emerging markets, we see a significant amount of infrastructure asset growth, as a result of rising populations, urbanisation and the growing demand for cleaner energy and better transport links.”

It is clear infrastructure needs to be improved drastically, not just in the UK but in most developed and all developing markets.