“By banning commissions from fund issuers, RDR has changed the value proposition for independent financial advisers in the UK, moving from fund picking to deeper financial planning,” Mr Fitzgerald said.

Daniel Greenhough, investment manager at St Albans-based Lumin Wealth, says the use of ETFs is increasing among advisers like him, as well as discretionary fund managers, in part because more investment platforms have made ETFs available to trade.

In addition, ETFs are growing so rapidly because they offer investors an attractive and efficient way to implement both passive and active investment strategies.

“Investors are increasingly blending ETFs with active funds in their portfolios to best fit their investment objective,” Mr Parkin said.

“For example, ETFs can be used as the main component of an investor’s portfolio or a core satellite approach, whereby they allow an investor to tactically tilt their portfolio.

“When blending active funds with ETFs, investors often use an ETF when it can be difficult for an active manager to outperform the market, or to gain exposure to a market that is otherwise difficult to access.”

Mr Greenhough says he is seeing an increasing number of managed portfolio service providers launching passive only model portfolios for advisers to sell to clients.

Availability

The number of ETFs and ETPs on the market has certainly skyrocketed. In 2006 there were 888 different products availbel - at the end of December 2016, the Global ETF/ETP industry had 6,625 ETFs/ETPs, with 12,526 listings, from 290 providers listed on 65 exchanges in 53 countries.

On a practical basis, Mr Greenhough believes the amount of time spent on due diligence and ongoing monitoring is lower for ETFs than active managers. This is going to be attractive to a time pressured adviser.

He attributes part of the growing popularity of ETFs to marketing carried out in the US finding its way over here and influencing investors.

“The percentage of active funds outperforming the US market is generally lower over time than it is for managers trying to beat the UK market,” he says.

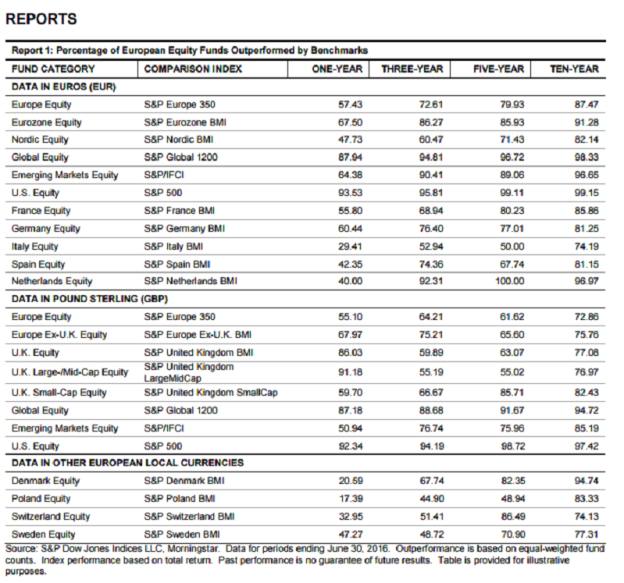

“Although it is not an assets under management weighted piece of research, the reports produced by S&P Dow Jones suggest over a five-year period only 1 per cent per cent of US fund managers outperformed, whereas in the UK 37 per cent outperformed (source: Mid-year 2016 SPIVA Europe Scorecard below).

Luis Rivera, CEO and co-founder of ETFmatic, a robo-adviser specialising in the funds, believes even the huge growth in ETFs over the last decade is “significantly slower than it’s about to grow”.

“Mobile Internet has changed the rules of the game and Europeans have finally got tired of being abused by banks and betting on fund managers that underperform. We have a lot of catching up to replicate distribution in the US market; among others in terms of investor education.”